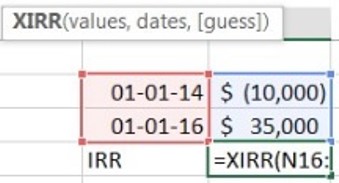

However, this requires further assumptions (i.e. Values of each and every return at the end of the investment tenor is the moreĪccurate alternative method. ThisĪpproach does not take the value of time into account – note that a return inĪn earlier period is usually more valuable than one in a later period – and isĬalculating and considering the sum of the future This is often done in a rough wayīy using the sum of these returns as a total return in the last period. To be accumulated to apply the above formula. May produce returns before the end of the projection. However, other investments and types of projects Yields over time which are paid at maturity. This is appropriate for compounded investments, e.g.

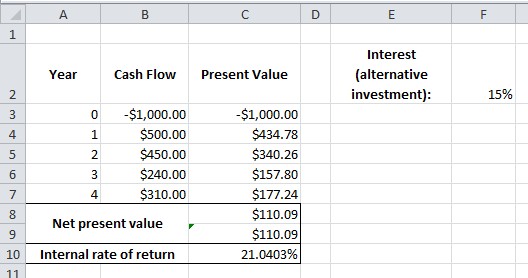

In the form of a single cumulative inflow in the last period of the investment’s This approach assumes that all returns occur Disadvantages and Modifications of this Method The result is the annualized return in percent which however is not as accurate as the internal rate of return method if cash flows occur between the first and last periods. Whether cash flows occur at the end (the typical case) or beginning of aĬalculating the ROI for multiple periods in Excel using the RATE function. amortization of the initial investment) at the end of the time horizon, With the investment amount (negative figure, representing an initial cash It requires the parametersĬan remain empty for the purpose of this calculation, Subsequently, r (in %) is the relevant measure to compare differentĭetermined by using the RATE Function. To the future value formula (FV = (1+r)^t) solved for r as the periodic (e.g. The first component of this formula is similar R = return per period (the equation needs to be solved for r) The Return on Investment formula is as follows: Thus, an investment with returns over 2 years can be compared with an investment for 4 years, for instance. The ROI for multiple periods distributes the return earned at the end of the investment’s tenor across the periods. Will then be able to compare the annualized ROI of the different alternatives. If you are comparing project options and investmentĪlternatives with different tenors, you achieve more accurate results when youĪre using the ROI formula for multiple years instead of the basic ROI concept. How Is the Return on Investment Calculated for Multiple However, this is not as accurate as the multi-period ROI that is introducedīelow. Project alternatives can be compared using a basic ROI as long as it relates toĪ small number of periods and the tenors of all alternatives are identical. If this aspect is not deemed material, investment and Periods which however may not be accurate as the value of time may not be In practice, it is also used for multiple

Single-period projects and investments (e.g. How Is the Return on Investment Calculated? The Basic ROI FormulaĬalculated by dividing the returns after cost by the investment: The ROIs of investment alternatives with a different tenor or different cashįlow characteristics ( source). Returns that are earned over multiple periods or years. Therefore, there is a specific formula for Receiving a return at an early or late point in your projection. It does make a difference whether you are What Is Return on Investment for Multiple Years? This helps compare alternatives with different investment amounts where absolute returns would not be an appropriate measure for comparison purposes. The result is a ratio of benefits and returns in relation to investment and costs. As the ROI is a percentage value, it can be used to compare different projects and investment alternatives with respect to their profitability. The return on investment is an indicator of the profitability of an investment or a project. What Are the Advantages and Disadvantages of the ROI?.Example 2) Use of Single- and Multi-Period ROI to Compare.Example 1) Investment with a Single Return at Maturity.Examples of Basic and Multiple Years ROI.The ROI Calculator – Calculate the Return on Investment (Basic.What Are the Types of Cost and Investment Considered for.What Are the Types of Returns Considered for ROI?.Considerations when Calculating the Return on Investment.Disadvantages and Modifications of this Method.How Is the Return on Investment Calculated for Multiple.How Is the Return on Investment Calculated?.What Is Return on Investment for Multiple Years?.What Is the Return of Investment (ROI)?.

0 kommentar(er)

0 kommentar(er)